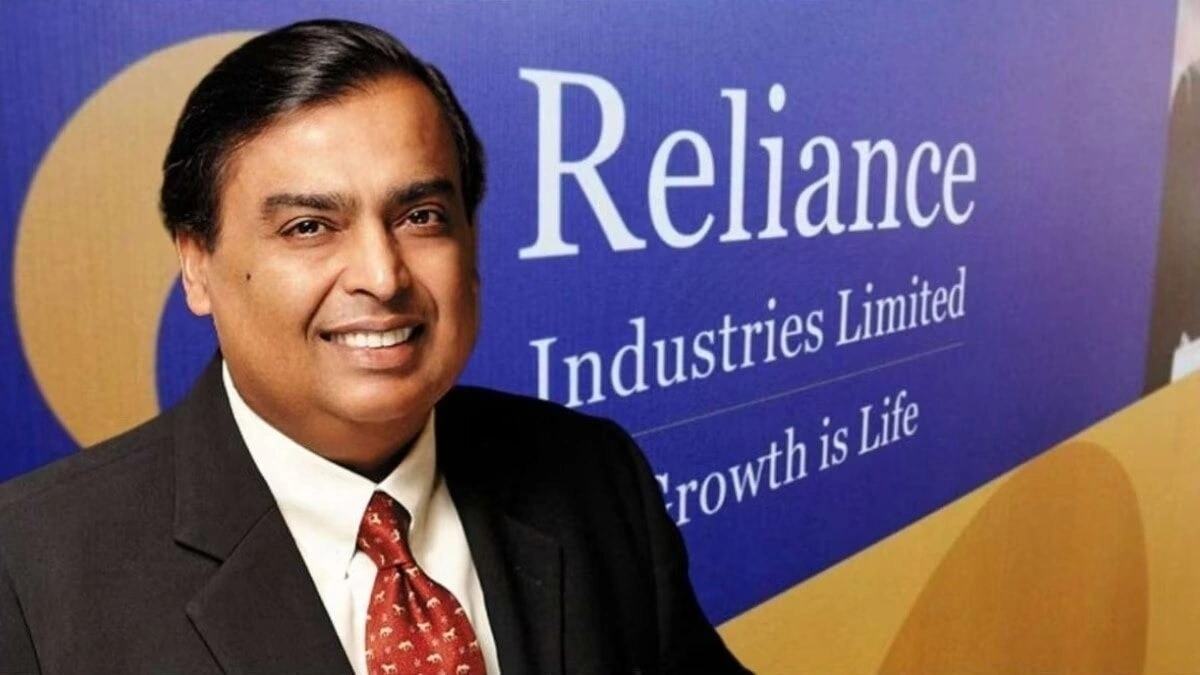

Reliance Share Price | Decoding the Dip – Is Now the Time to Buy?

The reliance share price has been a topic of heated discussion lately, hasn’t it? It feels like every other day, there’s a new headline, a fresh analysis, and a whole lot of speculation. But let’s be honest – wading through all that noise to figure out what’s really going on can be exhausting. So, instead of just throwing numbers at you, let’s dive into the “why” behind the fluctuations. Forget the surface-level news; we’re digging deeper.

Understanding the Market Mood Swings

Here’s the thing: the stock market is emotional. It reacts to everything from global economic trends to the whispers of insider trading. When it comes to reliance industries , there are a couple of factors at play right now. Firstly, global uncertainty – rising inflation, potential recession fears – always puts pressure on even the bluest of blue-chip stocks. And secondly, specific news relating to Reliance’s various ventures can cause immediate price adjustments.

Think of it like this: Reliance isn’t just one company; it’s a massive conglomerate with fingers in everything from telecom (Reliance Jio) to retail (Reliance Retail) to energy. Any significant development in any of these sectors has a ripple effect. According to market analysts atInvestopedia, diversification is usually a strength, but it also means more exposure to different market forces. It’s a double-edged sword, really.

The Jio Effect and Future Growth

One area that constantly keeps popping up in conversations is Reliance Jio. And for good reason! The telecom sector in India is fiercely competitive. While Jio has undeniably disrupted the market and gained a massive user base, sustaining that growth and profitability is a constant challenge. What fascinates me is how Jio plans to leverage its 5G rollout. Will it translate into significant revenue gains? Will they successfully compete with companies offering similar services? These are the questions the market is grappling with, and they directly influence the nse reliance share price.

But, let’s not forget Reliance Retail. It’s been expanding aggressively, acquiring new brands and solidifying its position in the Indian market. Its success will play a vital role in maintaining the company’s growth momentum. Don’t forget to check Vikram Solar , which is another growth sector.

Decoding the Financial Jargon | Key Metrics to Watch

Alright, let’s get a little technical – but I promise to keep it simple! When evaluating reliance stock analysis , you can’t just look at the price chart. You need to dig into the financials. I’m talking about things like:

- Price-to-Earnings Ratio (P/E): This tells you how much investors are willing to pay for each rupee of Reliance’s earnings. A high P/E can indicate that the stock is overvalued, while a low P/E might suggest it’s undervalued.

- Debt-to-Equity Ratio: Reliance has taken on significant debt to fuel its expansion. This ratio helps you understand how much debt the company has compared to its equity. Too much debt can be a red flag.

- Free Cash Flow: This is the cash the company generates after accounting for capital expenditures. Healthy free cash flow indicates that Reliance has ample resources to invest in future growth or return value to shareholders.

I initially thought this was straightforward, but then I realized – these metrics are just data points without context. You need to compare them to Reliance’s historical performance and to its competitors in the industry. That’s where the real insights lie.

Insider Insights | What Are the Big Players Doing?

Here’s a crucial piece of the puzzle many investors overlook: keep an eye on what the big institutional investors are doing. Are they buying or selling reliance share price target ? Large-scale transactions by these players can often signal future price movements. You can usually find this information in quarterly reports filed with regulatory bodies. Analyzing these transactions, alongside Patel Retail, is like reading the tea leaves of the market – it’s not foolproof, but it can give you a significant edge. For more details, visit:SEBI.

The Million-Dollar Question | Buy, Sell, or Hold?

Okay, let’s address the elephant in the room: should you buy, sell, or hold your Reliance shares? Honestly, there’s no one-size-fits-all answer. It depends entirely on your individual investment goals, risk tolerance, and time horizon. But here’s my take:

If you’re a long-term investor with a high-risk tolerance, this dip in the reliance industries share price could be an opportunity to accumulate more shares at a lower price. Reliance has a proven track record of innovation and growth, and its diversified business model makes it relatively resilient. However, if you’re a short-term trader or you’re highly risk-averse, you might consider trimming your position or waiting for more clarity in the market.

Ultimately, the best decision is an informed decision. Do your own research, consult with a financial advisor if needed, and don’t let emotions dictate your actions. The Indian stock market is tricky; it requires patience, discipline, and a healthy dose of skepticism.

FAQ Section

Frequently Asked Questions

What factors affect Reliance share price?

Global economic trends, industry-specific news, company performance, and investor sentiment all influence the reliance share price.

Is Reliance a good long-term investment?

Reliance has shown a proven record of growth in its diverse business. Long-term opportunities exist, but due diligence is always recommended.

Where can I find reliable Reliance share price information?

Reputable financial websites, brokerage platforms, and news sources offer real-time data and analysis.

How often does the share price of reliance industries change?

The share price fluctuates continuously during trading hours based on market activity.